how to pay late excise tax online

The use tax rate is the same as your sales tax rate. If you have to pay excise tax on your personal property or real estate you need to know how to do so online.

With the new system residents are able to opt-in and review bills.

. Visit their website here. Payment at this point must be made through our Deputy Collector Kelley. The excise tax is deposited in the Black Lung.

How To Pay Excise Tax Online. There will be a convenience fee associated with an online payment. Where do you pay late Motor Vehicle Excise taxes.

Learn about excise tax and how Avalara can help you manage it across multiple states. Normally if the car is registered in the drivers name the registration creates an obligation and. Pay traffic tickets online.

Hopedale MA 01747 508-473-9660. Phone - Taxes - 866541-4097 WaterSewer - 866541-4098 convenience fees are added at check-out for card use e-check available at no charge. Depending on the circumstances the Department may grant extensions for filing an excise tax return.

Kelly Ryan Associates 3 Rosenfeld Dr. Fill out the form you need to file. Current Fiscal Year Tax Rate.

Internal Revenue Code 4121 imposes an excise tax on coal from mines located in the United States sold by the producer. The Town will be utilizing City Hall Systems. Download permit application and informational packets.

Go to our online system. You need to enter your last name and license plate number to find your bill. Do you pay excise tax on a lease.

The tax collector must have received the payment. Access information on the tax collection process for late filling or paying back taxes. A motor vehicle excise is due 30 days from the day its issued.

For payment of motor vehicle excise tax or a parking ticket please have your. Select the TTB form you want to file. Sequentially number your excise tax returns for the entire calendar year and start your serial numbers over at 01 at the beginning of each calendar year.

Once completed click the NEXT button within the option you choose. Leased cars are still subject to excise tax. Payment by credit card or electronic check may be made online through Invoice Cloud.

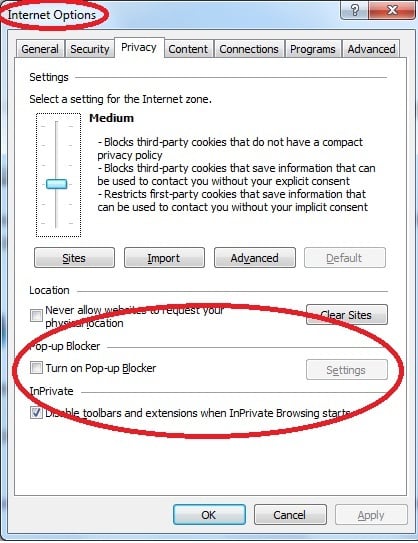

For example if you owe 2500 and are three months. It appears that your browser does not support JavaScript or you have it disabled. The request must be made before the due date.

You can pay your excise tax through our online payment system. To find out additional information regarding taxes please visit Tax Collection. First you must obtain your bill.

Excise tax return extensions. Where do you pay late Motor Vehicle Excise taxes. You must file an excise tax return.

If you own or lease a vehicle in Massachusetts you will pay an excise tax each year. If JavaScript is disabled in your browser please. How to pay late excise tax online Tuesday March 8 2022 Edit.

HM Revenue and Customs HMRC accepts. You will generally need to pay excise duty on either a prepayment basis or a periodic settlement basis when you lodge your excise return. The Collection Process and Taxpayer Rights The Collection Process IRS Notices and.

Excise Tax on Coal. Not just mailed postmarked on or before the due date. In all situations payment of excise duty is due at the.

Avoid late payment taxes by paying your taxes conveniently online. Please have your bill handy. Once completed click the NEXT button within the option you choose.

If you are not sure which form you need please visit. File TTB form on Paygov. Residents can make tax payments online.

Drop Box - Drop boxes are for check. Learn about excise tax and how Avalara can help you manage it across multiple states. Once you enter your NAME please CLICK one of the options below to continue entering specific information.

This system is an improved way for residents to pay bills online. Go to our online system. Create account on Paygov.

Excise tax return extensions. Ad Find out what excise tax applies to and how to manage compliance with Avalara. Schedule for semi-monthly quarterly and FAET filers.

Not paying on time will result in extra costs such as interest. Late-filing penalties can mount up at a rate of 5 of the amount due with your return for each month that youre late. How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal.

Ad Find out what excise tax applies to and how to manage compliance with Avalara. File a permit application to receive approval to. The excise rate is calculated by multiplying the value of the vehicle by the motor vehicle.

Get tax due dates. Acknowledge the warning banner by clicking the button marked CONTINUE. Use tax unlike sales tax is due at the rate where you first use.

Motor Vehicle Excise Information Methuen Ma

Corporate Excise Tax Penalties Waived S Corporation Fiscal Year Corporate

Town Of Fairhaven Collector S Office Reminder Excise Tax Bills Were Mailed On February 7 2019 And Are Due On March 8 2019 If You Have Not Received Your Bill Contact The Collector S

2021 Motor Vehicle Excise Tax Bills Fairhavenma

Online Bill Payment Town Of Dartmouth Ma

2022 Motor Vehicle Excise Tax Bill Mailed Fairhavenma

What Is Excise Tax Turbotax Tax Tips Videos

A Guide To Your Annual Motor Vehicle Excise Tax Wwlp

Tax Collector Frequently Asked Questions Town Of North Providence Rhode Island

Outstanding Excise Tax Bills Due Before May 10 2022 To Avoid Late Fees City Of Taunton Ma

Online Bill Payments City Of Revere Massachusetts

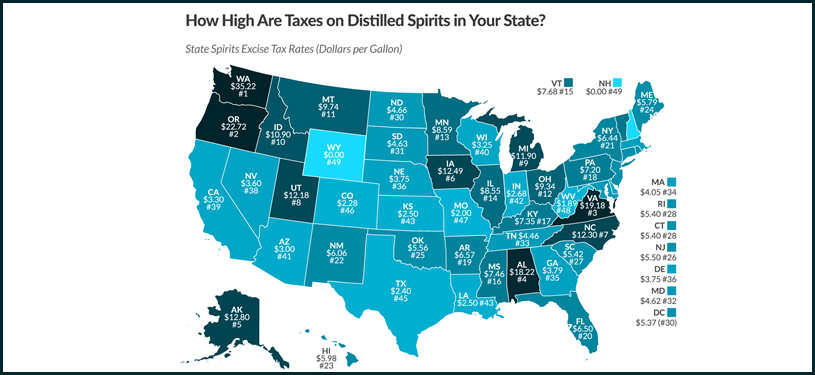

Part 2 How High Are Distilled Spirits Excise Taxes In Your State Infographic Distillery Trail

Canadian Cannabis Producers Overdue Excise Taxes More Than Triple To Ca 52 Million

Distilled Spirits Excise Tax Rates Around The Globe Five X 5 Solutions