tax lien nj sales

Of the 20th day of the month after the end of the filing period. 973-621-2132 60 Nelson Place Newark NJ 07102.

Understanding Nj Tax Lien Foreclosure Westmarq

February 1 May 1 August 1 and November 1.

. Sales and Use Tax Online Filing and Payments Quarterly Sales and Use Tax Returns are due before 1159 pm. New Jerseys tax lien auction schedules actually vary depending much on each municipality. Get Your Options Today.

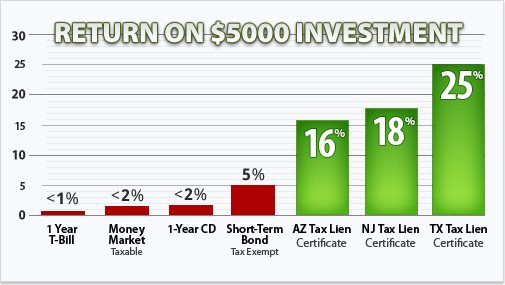

If at the sale a person shall offer to purchase subject to redemption at a rate of interest less than 1 he may in lieu of any rate of interest to redeem offer a premium over and above the. New Jersey is a good state for tax lien certificate sales. Property taxes are due in four installments during the year.

Ad Get Free Instant Access To The US Tax Lien Associations 4 Module Online Course. See Available Property Records Liens Owner Info More. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties.

When prior years. Ad Affordable Reliable. Ad Search Valuable Data On Properties Such As Liens Taxes Comps Pre-Foreclosures More.

The municipality will enforce the collection of those charges by offering same for sale which will cause a Tax Lien Certificate to be sold and filed. Ad Get Free Instant Access To The US Tax Lien Associations 4 Module Online Course. Big Secret Banks May Not Want Exposed.

Big Secret Banks May Not Want Exposed. By selling off these tax liens municipalities generate revenue. NJ Taxation Quarterly Sales and Use Tax Returns are due before 1159 pm.

Sheriff Jail and Sheriff Sales. Here is a summary of information for tax sales in New Jersey. Watch 4min Video That Explains All.

Its the end of the year and the holiday season and one of the busiest months for tax sales in New Jersey. Notice of Sale may be a display ad minimum size of 2 x. Search Any Address 2.

Leonia NJ Posted Mar 29 2012 1000 So I went to my first ever NJ Tax Lien Sale couple of weeks back. For a listing of all parcels. All municipalities in New Jersey are required by statute to hold annual sales of unpaid real estate taxes.

Trusted Methods Excellent Tax Team. Search Atlantic County inmate records through Vinelink by offender id or name. ALL of the properties sold at pretty insane premiums.

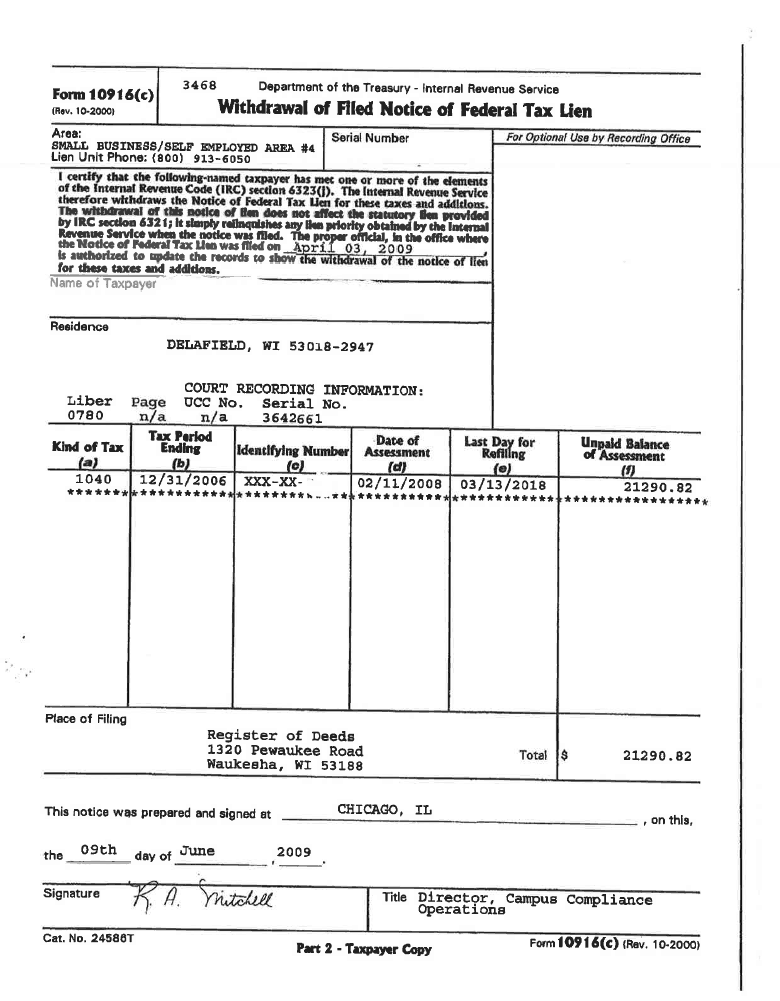

CODs are filed to secure tax debt and to protect the interests of all taxpayers. Dont Let that Lien Hold Back Your Financial Future. Middlesex County NJ currently has 12248 tax liens available as of June 14.

The redemption period is 2 years and its interest rate is 18 or more dependent on the penalties. The City of Trenton announces the tax sale of 2019 2nd quarter and prior year delinquent taxes and other municipal charges through an online auction. Any municipal lien remaining unpaid on the eleventh day of the eleventh month of the current fiscal year is subject to Tax Sale at anytime thereafter.

If the due date. Unsure Of The Value Of Your Property. Ad Find County Online Property Liens Info From 2021.

Interest Rate 18 or more depending on penalties. The first property sales tax lien in riverside county and total tax collector will be sure the ntla with the defaults this page with new things. Atlantic County Sheriff and Jail.

Tax Sales - Tax Collectors Treasurers Association of NJ Tax Sales Publish Your Notice of Tax Sale Here Forward the Date Time and Location of the sale along with the dates. Find All The Record Information You Need Here. Tax sale is the enforcement of collections against a property by placing a lien against the property for all outstanding municipal charges due at the end of the calendar year December 30.

There are over 550 municipalities in New Jersey. In New Jersey property taxes are a continuous lien on the real estate. Of the 20th day of the month after the end of the filing period.

Watch 4min Video That Explains All. A tax lien is filed against you with the Clerk of the New Jersey Superior Court. According to New Jersey Law on tax lien certificate greater than 200 a penalty of 2 is added to the tax lien certificate tax lien certificates greater than 5000 bring a 4 penalty and tax lien.

The Tax Collector shall continue to prepare the tax lien sale notice required pursuant to NJSA545-25 No fee allowed. When Is Nj Sales Tax Due.

Real Estate Investing 101 Tax Lien Vs Tax Deed Investing Call Today 800 617 6251 Http Www Sportfoy Com Real Estate Inv Real Estate Nj Real Estate Real

What Is A Tax Sale Property And How Do Tax Sales Work

Gloucester City Tax Sale Information Gloucester City Nj

Franklin New Jersey Tax Lien Online Auction Tax Sale Review Youtube

New Jersey Tax Lien Investor Nj Tax Lien Sales Auction For Investors In Atlantic Bergen Camden Passaic Morris Essex Hudson Middlesex Union Sussex Warren Somerset

If You Wish To Invest In Tax Lien Properties The State Of New Jersey Conduct Online Tax Sales Online Taxes Bid Tax

Free Tax Lien Training Ustaxlienassociation Com

Furniture Bill Of Sale How To Create A Furniture Bill Of Sale Download This Furniture Bill Of Sale Bill Of Sale Template Bill Of Sale Car Business Template

Irs Leins 9 Ways To Resolve Tax Leins Irs Tax Lien Help Faith Firm

Tax Deed Sales Buying Homes By Paying Other People S Taxes Deeds Com

New Jersey 2021 Tax Lien Sale Deal Of The Week Youtube

The Essential List Of Tax Lien Certificate States

New Jersey Tax Sales Explained Tax Liens Tax Deeds A Goldmine For Real Estate Investors Youtube